2.2 Ways To Invest

"Don't look for the needle in the haystack. Just buy the haystack!" - John C. Bogle

Welcome to the wacky world of investments, where your money can do everything from playing the steady, reliable role of a tortoise to performing high-flying acrobatics like a caffeinated squirrel on a trampoline. In the stock market, you can own a slice of your favorite pizza chain, feeling like a VIP every time you order a large pepperoni. Bonds, on the other hand, are like lending money to your slightly boring but dependable uncle who promises to pay you back with a little extra on top. Mutual funds and ETFs are the buffets of the investment world—why pick one dish when you can sample a bit of everything? Real estate lets you channel your inner Monopoly mogul, buying up properties and hoping you don’t land on anyone else’s hotel. And then there’s cryptocurrency, the financial equivalent of finding a golden ticket in your chocolate bar—exciting, unpredictable, and possibly life-changing. So, fasten your seatbelt, grab your Monopoly money, and dive into the diverse, sometimes dizzying world of investments.

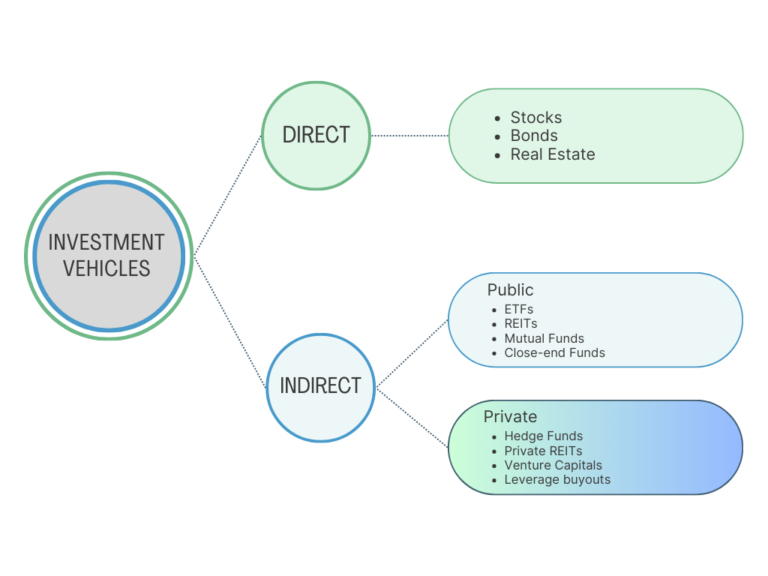

Investment Vehicles

Investments can be broadly categorized into several types based on their characteristics, risk levels, and return potential. Here are the types of investments that we will focus on:

Stocks (Equities)

- Common Stocks: Ownership shares in a company, giving shareholders voting rights and potential dividends.

- Preferred Stocks: Ownership shares without voting rights but with fixed dividends.

Mutual Funds

- Equity Mutual Funds: Invest primarily in stocks.

- Bond Mutual Funds: Invest primarily in bonds.

- Balanced Funds: Invest in a mix of stocks and bonds.

- Index Funds: Track a specific market index.

Exchange-Traded Funds (ETFs)

- Equity ETFs: Track stock market indices or sectors.

- Bond ETFs: Track bond indices.

- Commodity ETFs: Track the price of commodities like gold or oil.

Real Estate

- Residential Real Estate: Property for living purposes.

- Commercial Real Estate: Property for business purposes.

- Real Estate Investment Trusts (REITs): Companies that own or finance income-producing real estate.

Each type of investment comes with its own set of risks and potential returns, and they can be used in various combinations to achieve specific financial goals.