2.3 Investment Accounts

"Do not save what is left after spending, but spend what is left after saving." - Warren Buffett

Types of Investment Accounts

Before you can invest, you must know the following investment accounts to effectively manage your finances and achieve your financial goals. Firstly, a brokerage account allows you to buy and sell stocks, bonds, mutual funds, and ETFs, providing flexibility and control over your investment choices. Retirement accounts, such as Individual Retirement Accounts (IRAs) and 401(k) plans, offer tax advantages to encourage long-term savings, with traditional versions providing tax-deferred growth and Roth versions offering tax-free withdrawals. Additionally, a Health Savings Account (HSA) can be an excellent tool for investing in your health while enjoying triple tax benefits: contributions are tax-deductible, earnings grow tax-free, and withdrawals for qualified medical expenses are also tax-free. Understanding these accounts’ unique features and benefits is crucial in creating a diversified and tax-efficient investment strategy.

Here are the main types of investment accounts:

- Brokerage Account

- A general account that allows you to buy and sell a variety of investments, such as stocks, bonds, mutual funds, and ETFs.

- Retirement Accounts

- Traditional IRA (Individual Retirement Account)

- Contributions may be tax-deductible, and earnings grow tax-deferred until withdrawal.

- Roth IRA

- Contributions are made with after-tax dollars, but withdrawals in retirement are tax-free.

- 401(k)

- Employer-sponsored retirement plan with pre-tax contributions and potential employer matching. Earnings grow tax-deferred.

- Roth 401(k)

- Employer-sponsored plan with after-tax contributions, but withdrawals in retirement are tax-free.

- Traditional IRA (Individual Retirement Account)

- Education Savings Accounts

- 529 Plan

- Tax-advantaged savings plan designed for future education costs.

- Coverdell Education Savings Account (ESA)

- Allows tax-free withdrawals for qualified education expenses.

- State Prepaid Tuition Program

- Allows families to prepay for future college tuition at today’s rates, effectively locking in the cost and protecting against tuition inflation.

- 529 Plan

- Health Savings Account (HSA)

- Triple tax-advantaged account for individuals with high-deductible health plans. Contributions are tax-deductible, grow tax-free, and withdrawals for qualified medical expenses are tax-free.

- Custodial Accounts

- UGMA/UTMA (Uniform Gifts to Minors Act / Uniform Transfers to Minors Act)

- Accounts managed by an adult custodian until the minor reaches adulthood. Funds can be used for any purpose that benefits the child.

- UGMA/UTMA (Uniform Gifts to Minors Act / Uniform Transfers to Minors Act)

Contribution Limits (2024)

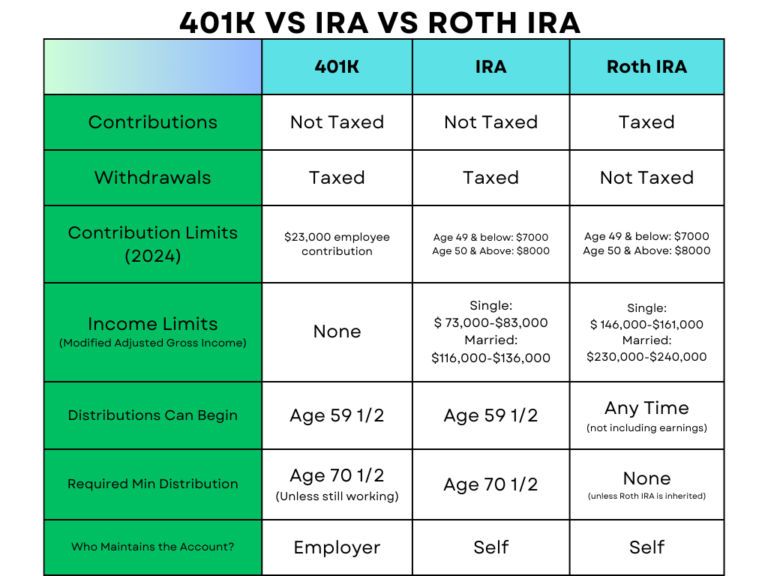

For 2024, the contribution limits for 401(k), IRA, and Roth IRA accounts are as follows:

401(k) Contribution Limits:

- Employee Contribution Limit: $23,000

- Catch-Up Contribution Limit (for those aged 50 and over): $7,500

- Total Contribution Limit (including employer contributions): $69,000

- Catch-Up Total Contribution Limit (including employer contributions): $76,500

IRA Contribution Limits:

- Contribution Limit: $7,000

- Catch-Up Contribution Limit (for those aged 50 and over): $1,000

Roth IRA Contribution Limits:

- Contribution Limit: $7,000

- Catch-Up Contribution Limit (for those aged 50 and over): $1,000

It’s important to note that the IRA and Roth IRA contribution limits are combined, meaning you can contribute a total of $7,000 across both accounts ($8,000 if you’re 50 or older). Additionally, income limits apply to Roth IRA contributions, and these limits can affect eligibility to contribute the maximum amount. Always consult with a financial advisor or tax professional to understand how these limits apply to your specific financial situation.

Income Limits (2024)

For 2024, the income limits for contributing to a Traditional IRA and Roth IRA are as follows:

The deductibility of contributions to a Traditional IRA depends on your filing status and whether you or your spouse are covered by a retirement plan at work.

If You Are Covered by a Retirement Plan at Work:

- Single or Head of Household:

- Full deduction if MAGI (Modified Adjusted Gross Income) is $73,000 or less.

- Partial deduction if MAGI is between $73,000 and $83,000.

- No deduction if MAGI is $83,000 or more.

- Married Filing Jointly:

- Full deduction if MAGI is $116,000 or less.

- Partial deduction if MAGI is between $116,000 and $136,000.

- No deduction if MAGI is $136,000 or more.

- Married Filing Separately:

- Partial deduction if MAGI is less than $10,000.

- No deduction if MAGI is $10,000 or more.

If You Are Not Covered by a Retirement Plan at Work:

- Single, Head of Household, or Married Filing Jointly (if your spouse is not covered by a plan at work):

- Full deduction regardless of MAGI.

- Married Filing Jointly (if your spouse is covered by a plan at work):

- Full deduction if MAGI is $218,000 or less.

- Partial deduction if MAGI is between $218,000 and $228,000.

- No deduction if MAGI is $228,000 or more.

- Married Filing Separately:

- Partial deduction if MAGI is less than $10,000.

- No deduction if MAGI is $10,000 or more.

Roth IRA Income Limits for Contributions

The ability to contribute to a Roth IRA is subject to income limits based on your filing status and MAGI.

- Single or Head of Household:

- Full contribution if MAGI is $146,000 or less.

- Partial contribution if MAGI is between $146,000 and $161,000.

- No contribution if MAGI is $161,000 or more.

- Married Filing Jointly:

- Full contribution if MAGI is $230,000 or less.

- Partial contribution if MAGI is between $230,000 and $240,000.

- No contribution if MAGI is $240,000 or more.

- Married Filing Separately:

- Partial contribution if MAGI is less than $10,000.

- No contribution if MAGI is $10,000 or more.

These income limits and contribution rules can change annually, so it’s a good idea to check the latest IRS guidelines or consult with a financial advisor to ensure you have the most up-to-date information.