When it comes to planning for retirement, time is one of your greatest allies. The sooner you start, the more benefits you’ll reap, especially if you’re considering opening a Roth IRA. But even if you haven’t started yet, opening a Roth IRA at least five years before retirement can still significantly impact your financial future. Here’s why timing is crucial and how you can make the most of your Roth IRA.

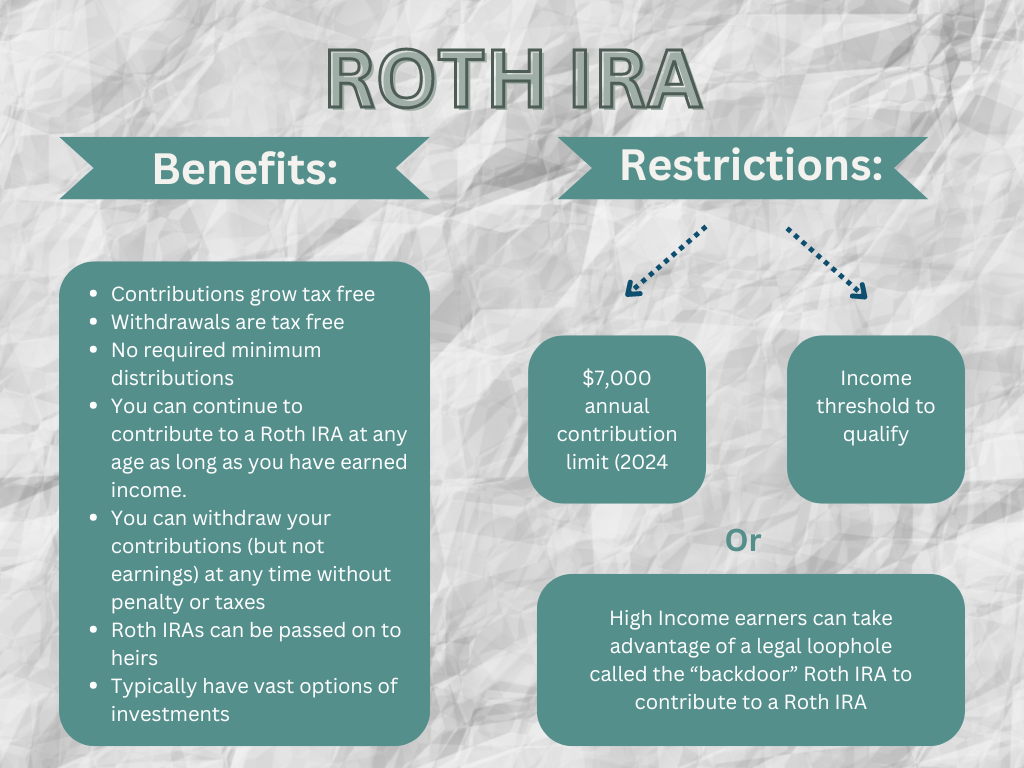

Why a Roth IRA?

First, let’s quickly recap why a Roth IRA is such a valuable retirement account. Unlike traditional IRAs, contributions to a Roth IRA are made with after-tax dollars, which means you won’t get a tax deduction upfront. However, the major perk is that qualified withdrawals in retirement are tax-free. That includes both your contributions and the earnings they’ve accrued over the years. This tax-free growth can be a game-changer for your retirement planning.

The 5-Year Rule: What You Need to Know

One critical aspect of the Roth IRA is the 5-year rule. To take tax-free withdrawals of your earnings, your Roth IRA must be open for at least five years. This rule applies regardless of your age. So, if you open your Roth IRA at age 60, you won’t be able to withdraw your earnings tax-free until age 65. This makes the timing of opening your account incredibly important.

Compounding Interest: The Early Bird Gets the Worm

The earlier you start contributing to your Roth IRA, the more time your money has to grow. Thanks to the power of compounding interest, your investments can generate earnings, and those earnings can generate even more earnings. For example, if you contribute $6,000 annually to your Roth IRA starting at age 25 and achieve an average annual return of 7%, you could have over $1 million by age 65. If you start at age 35, you could have around $500,000 by the same age. The difference is substantial.

Tax-Free Withdrawals: A Huge Benefit in Retirement

Imagine entering retirement and knowing that a portion of your income is entirely tax-free. With a Roth IRA, that’s a reality. Tax-free withdrawals can help you manage your tax bracket in retirement, avoid higher Medicare premiums, and keep more of your Social Security benefits untaxed. This flexibility can make a significant difference in your retirement lifestyle.

Starting Late? It’s Not Too Late!

Even if you’re closer to retirement and haven’t opened a Roth IRA yet, it’s still worth considering. Opening an account at least five years before you plan to retire ensures you’ll meet the 5-year rule when you start taking withdrawals. Plus, any contributions you make can still grow tax-free and provide additional financial security.

Steps to Open and Maximize Your Roth IRA

- Research and Choose a Provider: Look for a reputable financial institution or brokerage with low fees and a variety of investment options.

- Open Your Account: The process is usually straightforward and can be done online.

- Start Contributing: The annual contribution limit for 2024 is $6,500 (or $7,500 if you’re 50 or older).

- Invest Wisely: Diversify your investments to manage risk and aim for long-term growth.

- Stay Consistent: Make regular contributions to take full advantage of compound interest.

Conclusion

Opening a Roth IRA early—or at least five years before retirement—can significantly impact your financial future. The benefits of tax-free growth, tax-free withdrawals, and the power of compounding interest make the Roth IRA a valuable tool in your retirement planning toolkit. Don’t wait until it’s too late; take action now and set yourself up for a more secure and enjoyable retirement. Your future self will thank you!

Roth IRA For Absolute Beginners: A Guide to Retirement Savings | Learn the Ins and Outs of Roth IRAs, Employer Roth Options, Conversions, and Withdrawals for a Secure Financial Future Paperback – July 15, 2023 by Steven S. Rodgers (Author)

Welcome to “Roth IRA For Absolute Beginners.” Whether you’re just starting your financial journey or looking to optimize your retirement strategy, this guide is here to demystify the world of Roth IRAs and help you make informed decisions for a secure financial future.