2.4.7 Asset Assignment - Taxable Brokerage Account

"A well-managed taxable brokerage account can be your gateway to financial freedom and long-term prosperity."

F.I.R.E Early with a Taxable Brokerage Account

A taxable brokerage account can be a powerful tool for those aspiring to achieve financial independence and retire early. Unlike retirement accounts with contribution limits and withdrawal restrictions, a taxable brokerage account offers flexibility and accessibility. You can invest as much as you want and access your funds at any time without penalties, providing you with the liquidity to seize opportunities or address financial needs as they arise. This flexibility makes it an ideal vehicle for those who aim to build wealth and have control over their financial future.

Additionally, a taxable brokerage account allows for strategic tax management. While you pay taxes on dividends and capital gains, you can also take advantage of tax-loss harvesting to offset gains with losses, potentially reducing your overall tax burden. The ability to choose when to sell investments and realize gains offers a degree of control over your tax situation that is not available in tax-advantaged accounts. By thoughtfully managing your investments and tax strategies within a taxable brokerage account, you can maximize your after-tax returns, accelerating your path to financial independence.

What to Invest In?

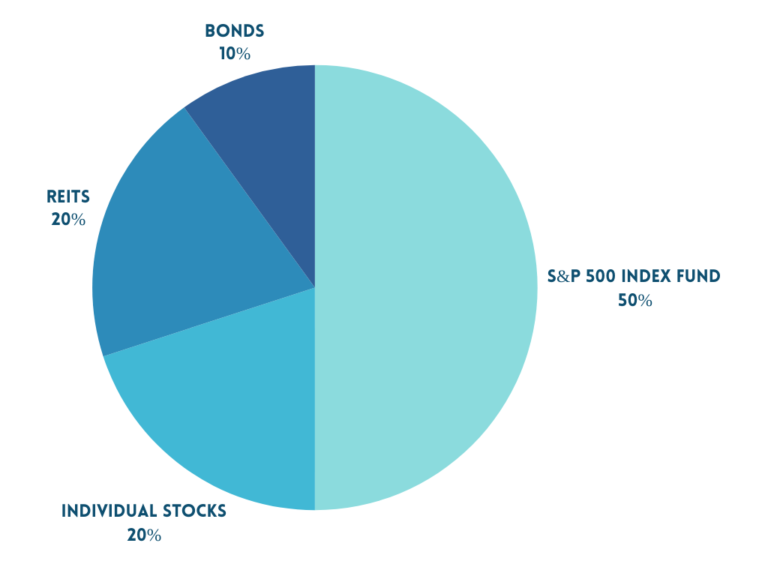

When investing in a taxable brokerage account, diversifying your portfolio is key to managing risk and maximizing returns. One effective strategy is to allocate 50% of your investment to an S&P 500 index fund. The S&P 500 represents a broad swath of the U.S. economy, encompassing 500 of the largest publicly traded companies. This index has historically provided robust returns, making it a solid foundation for long-term growth. By investing half of your portfolio in the S&P 500, you gain exposure to a diversified range of industries and companies, benefiting from the overall growth of the U.S. stock market.

Allocating 20% of your portfolio to individual stocks allows you to target specific companies that you believe have high growth potential. This approach can be riskier than investing in index funds, but it also offers the opportunity for significant returns if you pick the right stocks. Next, dedicating another 20% to Real Estate Investment Trusts (REITs) provides exposure to the real estate market, offering potential income through dividends as well as diversification benefits since real estate often performs differently than the stock market. Lastly, investing 10% in bonds can help balance your portfolio by providing stability and reducing overall volatility. Bonds typically offer lower returns compared to stocks but are less risky and can provide a steady stream of income, especially during market downturns. This balanced approach to investing in a taxable brokerage account can help you achieve growth, income, and diversification, aligning with your financial goals and risk tolerance.