2.4.6 Asset Assignment - Roth IRA

"The Roth IRA is a gift from the government to encourage Americans to save for retirement with tax-free growth." — Suze Orman

Roth IRA - Funds to Buy

When it comes to building a robust and straightforward investment strategy within your Roth IRA, a combination of 80% domestic Total Market index fund and 20% International Total Market index fund can be a powerful approach. This mix offers a well-balanced portfolio that captures a wide array of opportunities across both the U.S. and global markets, ensuring diversification and potential for steady growth.

Investing 80% of your Roth IRA in a domestic Total Market index fund provides comprehensive exposure to the entire U.S. stock market. This includes large, mid, and small-cap companies across various sectors, reflecting the overall performance and health of the American economy. Historically, the U.S. market has been a reliable engine of growth, benefiting from innovation, strong corporate governance, and economic stability. By capturing this broad spectrum, you reduce the risk associated with investing in individual stocks and benefit from the collective success of U.S. businesses.

On the other hand, allocating 20% of your Roth IRA to an International Total Market index fund introduces valuable global diversification. This fund includes companies from developed and emerging markets outside the U.S., spreading your investment across different economic environments and growth prospects. International markets often move independently of the U.S. market, providing a hedge against domestic downturns and capitalizing on growth opportunities abroad. This diversification not only mitigates risk but also opens up avenues for growth that may not be available solely within the U.S.

Furthermore, the simplicity of this 80/20 strategy makes it easy to manage and maintain. By sticking to broad-based index funds, you benefit from low expense ratios, which means more of your money is working for you rather than being eaten up by management fees. The passive nature of these funds also ensures that your portfolio is continuously adjusted to reflect the changing market landscape, without the need for constant oversight and rebalancing on your part.

In summary, investing 80% of your Roth IRA in a domestic Total Market index fund and 20% in an International Total Market index fund provides a diversified, low-cost, and straightforward approach to long-term growth. This strategy captures the broad performance of both the U.S. and global markets, reduces risk through diversification, and ensures that you are well-positioned to take advantage of opportunities wherever they may arise. It’s a practical and effective way to secure your financial future with minimal hassle.

"Total market index funds offer a cost-effective way to invest in the entire stock market, giving you broad exposure and lower risk." — Christine Benz

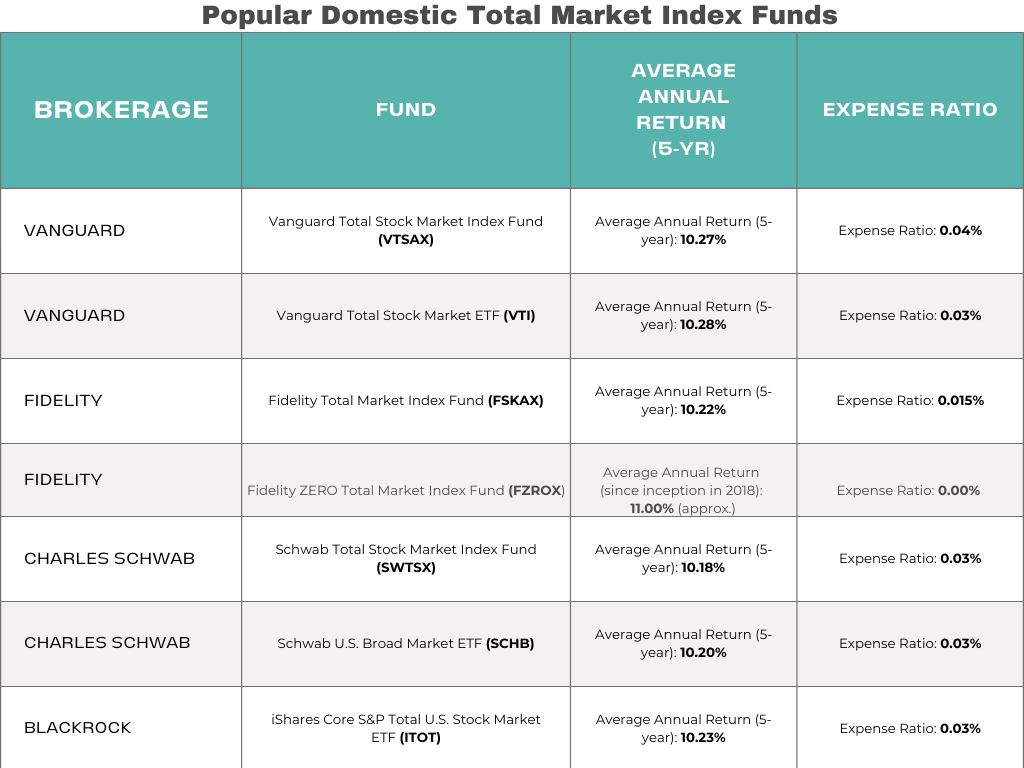

Domestic Total Market Index funds provide broad exposure to the entire U.S. stock market, offering diversification and potential for long-term growth at competitive expense ratios.

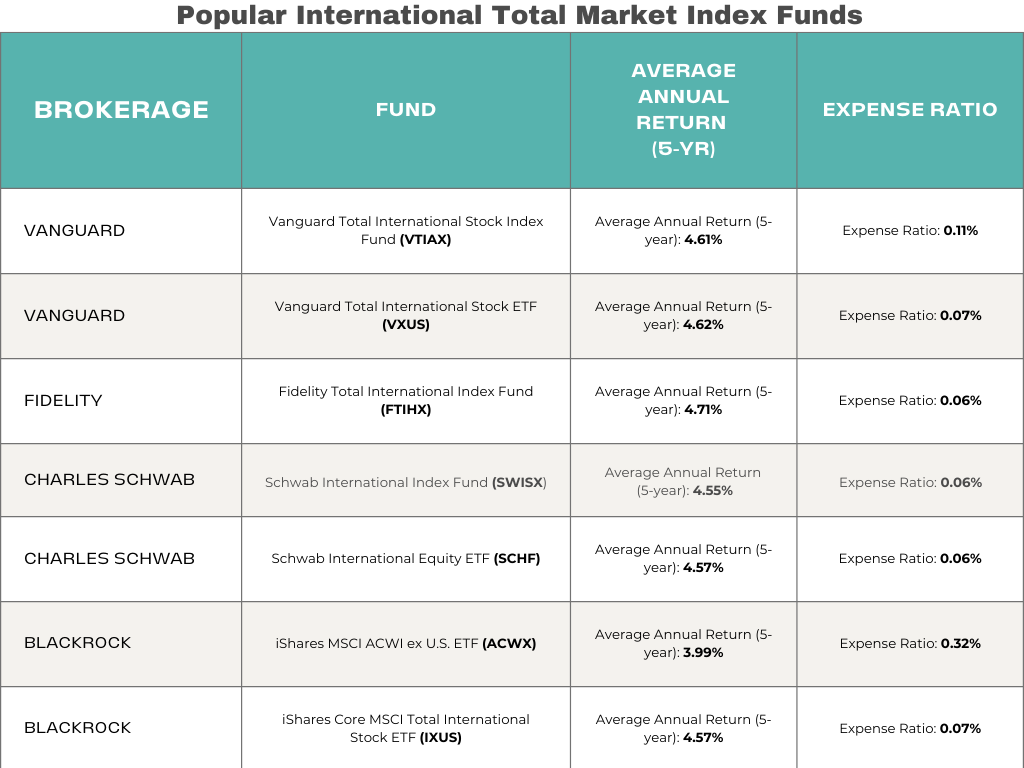

International Total Market Index funds offer broad exposure to international markets, providing a mix of developed and emerging market investments with competitive expense ratios and a solid track record of returns over the past five years.