"Finance is about numbers, but it’s also about predicting human behavior. AI helps us bridge both." - Cathy Bessant, former CTO of Bank of America

1. Smarter Budgeting and Expense Tracking

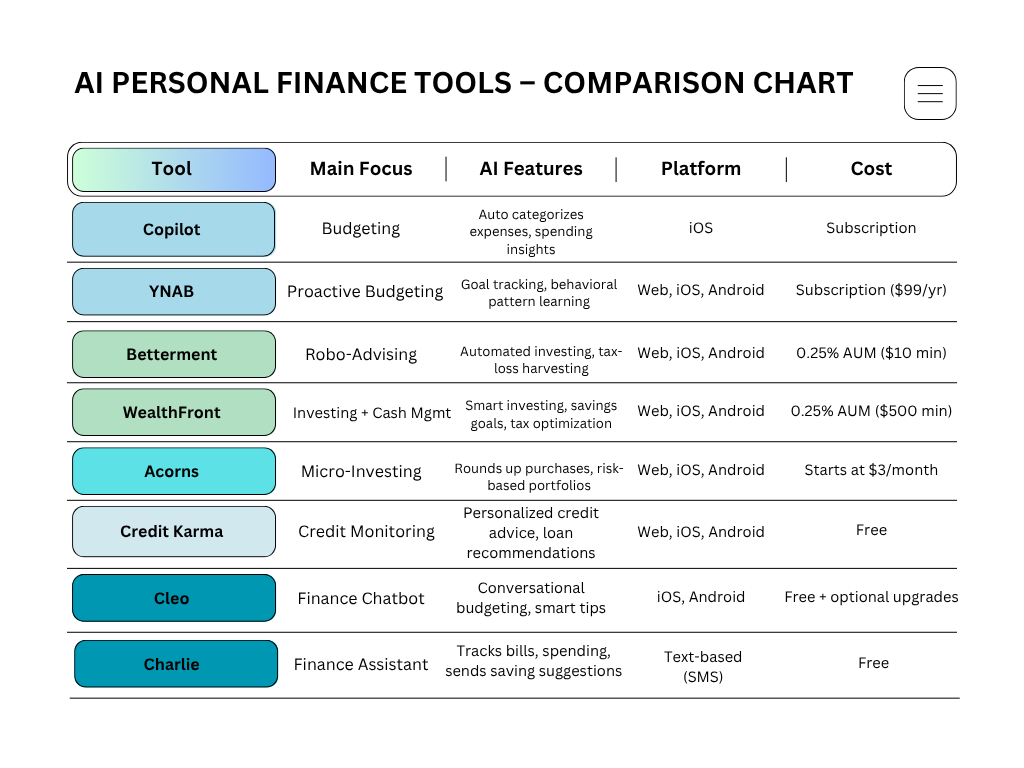

AI can analyze past spending behavior, detect patterns, and categorize expenses automatically. Apps like YNAB and Mint use AI-driven insights to help users manage their money in real time. These tools can also forecast future expenses based on historical data, providing personalized alerts and helping users adjust habits before problems arise.

2. Personalized Financial Advice

Traditional financial advisors often come at a premium cost. AI-based financial advisors — or robo-advisors — offer a more affordable alternative. Platforms like Betterment and Wealthfront use AI to assess risk tolerance, goals, and timelines to build personalized investment portfolios. These services continuously rebalance portfolios and optimize tax efficiency using algorithms, without emotional bias.

3. Predictive Analysis for Better Decision-Making

One of AI’s key strengths is its ability to process large volumes of data to make predictions. For individuals, this means better insight into cash flow forecasting, loan management, and investment outcomes. AI can simulate various financial scenarios — such as buying a house, paying off debt, or retiring early — and predict how these decisions affect long-term financial health.

4. Real-Time Alerts and Fraud Detection

AI-powered systems can monitor financial accounts for unusual activity and alert users instantly. This proactive approach to fraud detection provides peace of mind and can help prevent small issues from becoming major problems. In addition, AI tools can suggest corrective action when financial risks or irregularities are identified.

5. Improved Savings and Investment Automation

AI makes saving and investing easier and more disciplined. Apps like Digit and Acorns use AI to analyze spending habits and automatically move small amounts of money into savings or investment accounts. This “invisible” saving strategy helps individuals build wealth consistently without needing to make daily decisions.

6. Emotional Detachment from Financial Decisions

Humans are often driven by emotion when it comes to money — fear, greed, or impulse can derail even the best plans. AI, in contrast, offers data-driven objectivity. By automating routine decisions and providing clear analysis, AI helps individuals remain focused on long-term goals rather than reacting to market noise or short-term temptation.

Final Thoughts

AI is no longer a futuristic concept — it’s a practical tool that empowers individuals to take control of their finances with greater precision and confidence. By leveraging AI for budgeting, investing, forecasting, and more, people can make smarter, faster, and more informed financial decisions.

The age of personalized, intelligent financial planning is here — and it’s accessible to anyone with a smartphone and a willingness to embrace technology.