If you’re a high-income earner looking for tax-efficient ways to save for retirement, the Backdoor Roth IRA is a powerful strategy that allows you to bypass income limits and take advantage of the benefits of a Roth IRA. This guide will walk you through what a Backdoor Roth IRA is, why it’s beneficial, and the step-by-step process to execute one.

What is a Backdoor Roth IRA?

A Backdoor Roth IRA is a method for individuals who exceed the income limits for direct Roth IRA contributions to still contribute to a Roth IRA. This strategy involves making a non-deductible contribution to a traditional IRA and then converting those funds to a Roth IRA.

Here’s why it’s beneficial:

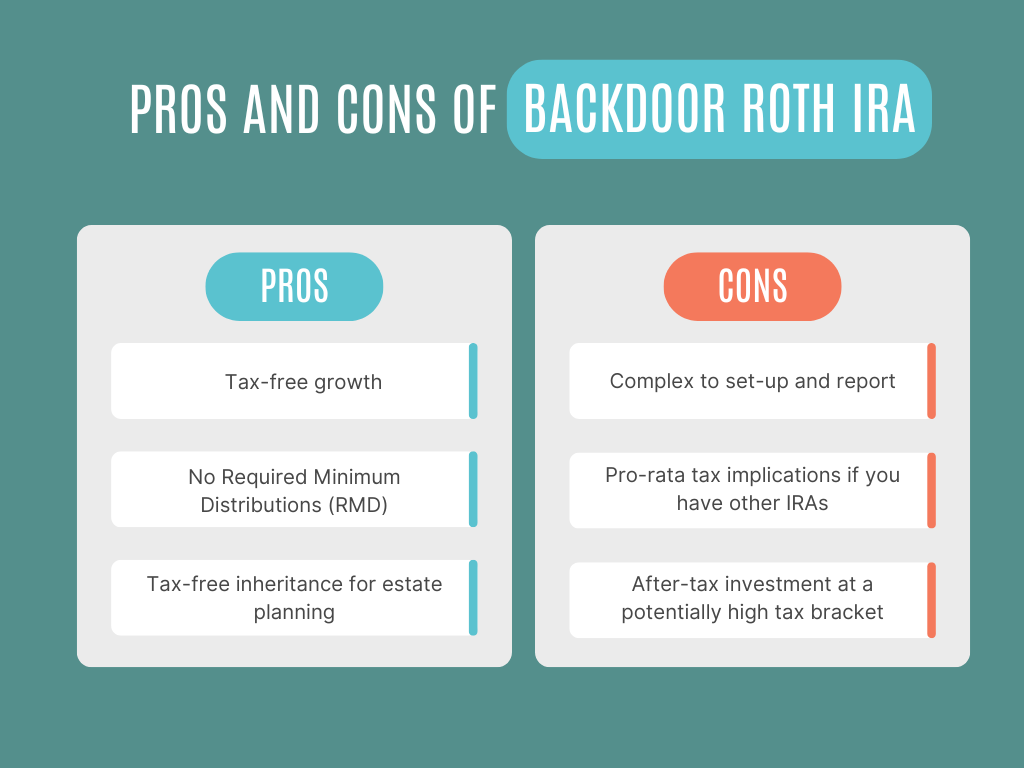

- Tax-Free Growth: Just like with regular Roth IRA contributions, the money grows tax-free, and withdrawals in retirement are tax-free.

- No Income Limits: There are income limits for contributing to a Roth IRA directly, but there are no income limits for converting a traditional IRA into a Roth IRA through this “backdoor” method.

- No Required Minimum Distributions (RMDs): Unlike traditional IRAs, Roth IRAs do not have RMDs, so your money can grow longer.

Why Consider a Backdoor Roth IRA?

- Higher Income Brackets: High-income earners who exceed the Roth IRA income limits for 2026 — $153,000 for single filers and $242,000 for married couples filing jointly — are barred from making direct Roth contributions. Contributions begin phasing out above these thresholds and are completely disallowed at $168,000+ (single) and $252,000+ (married filing jointly). Even if your income is above these limits, you can still contribute to a Roth IRA by using the backdoor strategy.

- Tax-Free Withdrawals: A Roth IRA provides tax-free income in retirement, meaning qualified withdrawals (after age 59½ and meeting the 5-year rule) aren’t taxed — a significant advantage if you expect to be in a higher tax bracket in retirement.

- Estate Planning: Roth IRAs can be passed on to heirs tax-free (subject to beneficiary RMD rules), making them an attractive tool for legacy planning, especially for those with high net worth who want to minimize tax drag on inherited assets.

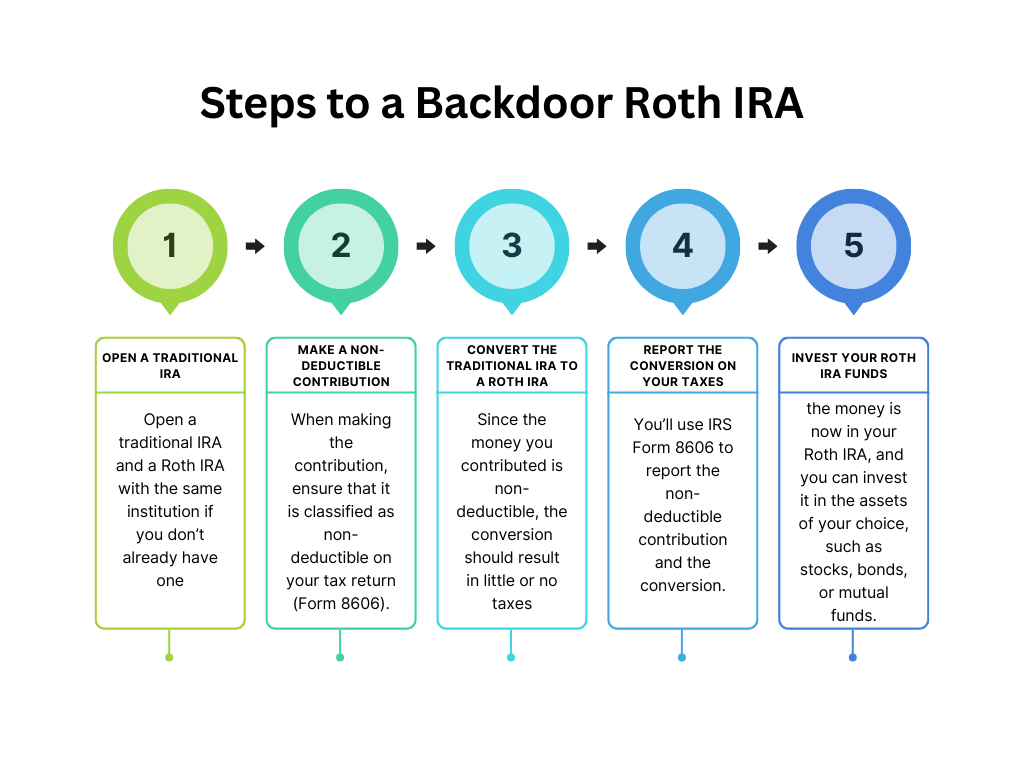

Step-by-Step Guide to a Backdoor Roth IRA

Here’s a simple breakdown of how to execute a Backdoor Roth IRA:

Step 1: Open a Traditional IRA

The first step is to open a traditional IRA if you don’t already have one. Most financial institutions, including brokerages and banks, offer IRAs, and the process is straightforward.

Step 2: Make a Non-Deductible Contribution

Since this strategy is designed for high-income earners, you won’t be able to deduct your traditional IRA contribution from your taxes.

For 2026, the contribution limit is:

$7,500 for those under 50

$8,600 for those 50 or older (catch-up contribution)

When making the contribution, ensure it is classified as non-deductible on your tax return (Form 8606).

Important: Avoid investing the money in stocks or other assets at this point, as gains before the conversion could complicate taxes.

Step 3: Convert the Traditional IRA to a Roth IRA

Once the contribution is made, the next step is to convert the traditional IRA to a Roth IRA. Most brokerages offer an option to easily convert IRAs online, or you can call them for assistance.

Since the money you contributed is non-deductible, the conversion should result in little or no taxes, provided you didn’t have any gains before conversion. Any taxable income will only come from the earnings on the contribution, which is why doing the conversion quickly minimizes tax consequences.

Step 4: Report the Conversion on Your Taxes

You’ll need to report the IRA contribution and the Roth conversion on your tax return. You’ll use IRS Form 8606 to report the non-deductible contribution and the conversion.

Key tax tips:

- If you have other traditional IRAs with pre-tax contributions, you could be subject to the pro-rata rule, which calculates taxes based on the ratio of after-tax to pre-tax IRA funds. This can result in a larger tax bill than expected.

- Consider rolling over any existing pre-tax IRAs into an employer-sponsored plan (like a 401(k)) before doing a Backdoor Roth to avoid the pro-rata rule.

Step 5: Invest Your Roth IRA Funds

Once the conversion is complete, the money is now in your Roth IRA, and you can invest it in the assets of your choice, such as stocks, bonds, or mutual funds. Since the money is in a Roth IRA, it will grow tax-free, and withdrawals in retirement will also be tax-free.

Key Considerations and Potential Pitfalls

While a Backdoor Roth IRA is a great strategy for many high-income earners, there are some important considerations to keep in mind:

The Pro-Rata Rule: As mentioned earlier, if you have other traditional IRAs with pre-tax contributions, the IRS requires you to pay taxes based on the ratio of after-tax to pre-tax funds across all your IRAs. This could significantly increase your tax liability during the conversion.

Aggregation Rule: The IRS views all your traditional IRAs as a single account when calculating the pro-rata rule. This means you can’t isolate just your non-deductible contributions for conversion—pre-tax amounts in other IRAs will factor into the tax calculation.

Timing the Conversion: If your non-deductible contribution gains value before you convert, you will owe taxes on the gains. To avoid this, try to make the conversion soon after the contribution is made, before the funds have a chance to grow.

Legislative Risk: While the Backdoor Roth IRA is currently a legal strategy, future tax law changes could potentially eliminate this loophole. Stay informed on tax law changes that could affect this strategy.

Conclusion

The Backdoor Roth IRA is an excellent strategy for high-income earners to take advantage of the benefits of a Roth IRA—tax-free growth and tax-free withdrawals in retirement. By following this step-by-step guide, you can bypass the income limits and build significant tax-free wealth for your future.

Remember, it’s important to consult with a financial advisor or tax professional before executing this strategy, especially if you have other traditional IRAs or complex tax situations. With proper planning, a Backdoor Roth IRA can be a powerful tool to boost your retirement savings and lower your future tax burden.