Understanding your financial health is crucial to achieving your long-term goals, whether it’s buying a home, retiring comfortably, or simply gaining peace of mind. One of the most effective ways to measure your financial progress is by calculating your net worth. In this blog post, we’ll guide you through the process of determining your net worth, explain why it’s important, and provide tips on how to improve it over time.

What is Net Worth?

Your net worth is essentially a snapshot of your financial situation at a given moment. It represents the difference between what you own (your assets) and what you owe (your liabilities). In other words, it’s the amount of money you would have left if you sold all your assets and paid off all your debts.

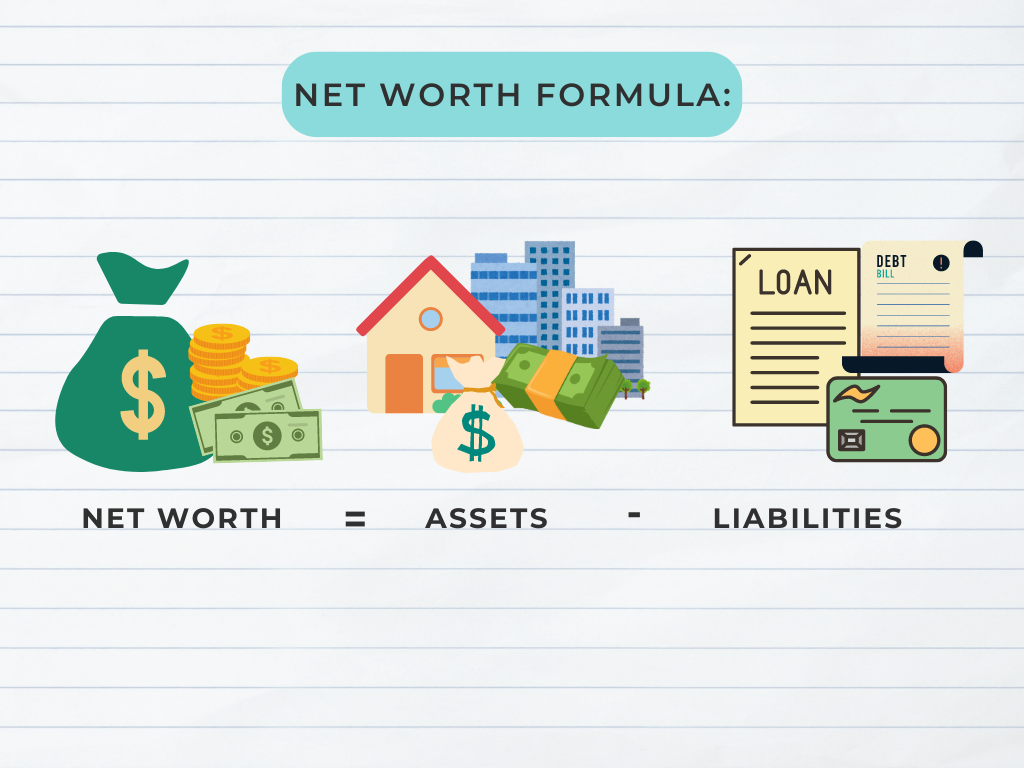

The formula is simple:

Net Worth = Total Assets – Total Liabilities

Understanding your net worth can help you assess your current financial situation, track your progress over time, and make informed decisions about your money.

Step-by-Step Guide to Calculating Your Net Worth

Step 1: List Your Assets

Assets are anything you own that has monetary value. Common types of assets include:

- Cash and Cash Equivalents: Savings accounts, checking accounts, and cash on hand.

- Investments: Stocks, bonds, mutual funds, retirement accounts (401(k), IRA), and other investment accounts.

- Real Estate: The current market value of your home, rental properties, or any land you own.

- Personal Property: Cars, jewelry, art, antiques, and other valuable possessions.

- Business Interests: Ownership in a business or partnerships.

To calculate the total value of your assets, list each asset and its current value, then add them all up.

Step 2: List Your Liabilities

Liabilities are the debts or obligations you owe to others. Common liabilities include:

- Mortgages: The outstanding balance on your home loan or any other real estate loans.

- Credit Card Debt: The current balances on all your credit cards.

- Student Loans: The remaining balance on any student loans.

- Auto Loans: The outstanding balance on any car loans.

- Personal Loans: Any other loans or debt obligations you have.

List each liability along with its current balance, then add them together to determine your total liabilities.

Step 3: Subtract Liabilities from Assets

Now that you have your total assets and total liabilities, subtract the total liabilities from the total assets:

Net Worth = Total Assets – Total Liabilities

The result is your net worth. If the number is positive, it means you own more than you owe. If it’s negative, it means you owe more than you own, and it might be time to reevaluate your financial strategy.

Why is Knowing Your Net Worth Important?

Calculating your net worth is more than just a number—it’s a powerful tool for financial planning. Here’s why it matters:

- Tracks Financial Progress: By regularly calculating your net worth, you can track your financial progress over time. An increasing net worth typically indicates that you’re on the right path toward your financial goals.

- Informs Financial Decisions: Knowing your net worth helps you make informed decisions, such as when to invest, save, or pay down debt.

- Sets Financial Goals: Understanding your net worth allows you to set realistic financial goals, whether it’s saving for retirement, paying off debt, or buying a home.

- Highlights Areas of Concern: If your net worth is negative or stagnant, it can be a wake-up call to address financial issues like excessive debt or insufficient savings.

Tips for Improving Your Net Worth

If you find that your net worth is lower than you’d like, or if you’re simply looking to boost it further, here are some strategies:

- Pay Down Debt: Focus on paying off high-interest debt, like credit cards, which can significantly improve your net worth.

- Increase Savings: Boost your savings by setting aside a portion of your income in a high-yield savings account or other investment vehicles.

- Invest Wisely: Consider investing in stocks, bonds, or real estate to grow your assets over time. Ensure your investment strategy aligns with your financial goals and risk tolerance.

- Reduce Unnecessary Expenses: Review your budget and cut out non-essential expenses. The money saved can be redirected toward paying off debt or increasing your savings.

- Increase Income: Look for opportunities to increase your income, whether through a raise, a side job, or passive income sources like dividends or rental properties.

Conclusion

Calculating your net worth is a crucial step in understanding and improving your financial health. It provides a clear picture of where you stand financially and helps guide your future financial decisions. By regularly tracking your net worth and taking steps to improve it, you can work towards a more secure and prosperous financial future.

Remember, improving your net worth doesn’t happen overnight—it’s a gradual process that requires discipline, planning, and patience. Start by calculating your net worth today, and use it as a benchmark for your financial journey.